-

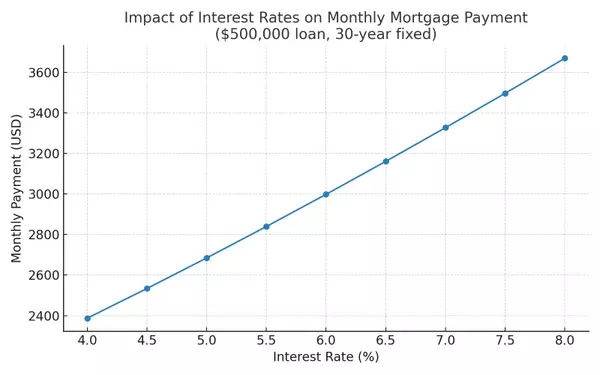

Favorable Interest Rates:

- Even though intrest rates have increased in the past few months, they are still relitively low historically. Good news is if you are able to secure a home now without the high competition, you can refiance to a lower rate as in early as 6 months.

-

Real Estate Market Trends:

- Positive trends in the real estate market, such as increasing property values, may suggest a good time to invest in a home.

-

Stability and Long-Term Investment:

- Real estate is often considered a stable, long-term investment. Buying a home can be a way to build equity and provide financial stability over time.

-

Tax Benefits:

- Homeownership can come with tax advantages, such as deductions for mortgage interest and property taxes, making it a financially attractive option.

-

Personalization and Stability:

- Owning a home allows for personalization and stability that renting might not provide. Homeowners have the freedom to make changes and create a living space that suits their preferences.

-

Building Equity:

- As mortgage payments are made, homeowners build equity in their property. Over time, this equity can be tapped into for various purposes, such as home improvements or other investments.

-

Potential for Rental Income:

- Buying a home with the intention of renting out a portion of it or the entire property can provide a source of passive income.

-

Family and Lifestyle Considerations:

- For those looking to start or expand a family, owning a home can provide a stable and secure environment. It can also cater to specific lifestyle needs, such as having a yard for pets or children.

-

Stable Monthly Payments:

- Fixed-rate mortgages provide predictability in monthly housing costs, offering stability compared to potential rent increases in the future.

-

Inflation Hedge:

- Real estate is often considered a hedge against inflation, as property values may appreciate over time, helping to preserve and potentially increase wealth.

While these reasons can be compelling, it's crucial to carefully assess personal financial situations, market conditions, and long-term goals before deciding to purchase a home. Consulting with a real estate professional and financial advisor can provide valuable insights tailored to individual circumstances.

Reach out to me TODAY to learn more about how you accomplish home ownership, 619.972.9462.