MAX Mortgage or Rent you should pay based on your income in San Diego

What Can You Qualify for When Buying a Home in San Diego?

If you're planning to buy a home in San Diego, one of the most important first steps is finding out how much home you qualify for.

Knowing your budget upfront will save you time, help you focus your search, and position you as a serious buyer when the right property hits the market.

Why Getting Pre-Approved Matters

A home loan pre-approval shows sellers that you’re financially prepared and ready to make an offer.

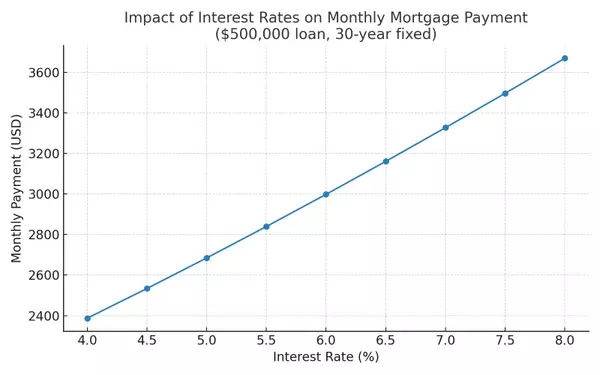

It also gives you a clearer understanding of what monthly payments will look like based on current mortgage rates and your personal financial situation.

As an experienced San Diego real estate agent, I work closely with trusted local lenders who can guide you through the pre-approval process quickly and easily.

When you're pre-approved, you'll know:

-

Your maximum purchase price Affordability Calculator

-

Your estimated monthly mortgage payment

-

Your down payment options and closing costs

-

What loan programs you qualify for (FHA, Conventional, VA, etc.)

The general rule is that your monthly rent or mortgage payment (including principal, interest, taxes, insurance — often called "PITI" for mortgages) should not exceed 28% to 30% of your gross monthly income (your income before taxes).

🔹 Conservative recommendation:

-

Housing costs ≤ 28% of gross monthly income, some higher cost real estate markets like San Diego and New York lenders look more at 30-35%

-

Total debt (including car loans, credit cards, student loans, etc.) ≤ 36% of gross monthly income (called the "28/36 rule").

🔹 Example:

-

If you make $100,000/year, that's about $8,333/month before taxes.

-

28% of that = $2,333/month max or 30% of that = $2,500/month max for rent or mortgage.

Some lenders may allow you to stretch to up to 35%–40% for housing costs depending on your credit, down payment, and debt levels — but that can feel "tight" in real life.

Living comfortably usually means sticking to the 28–30% range.

✅ This way you have room for savings, vacations, repairs, and breathing room if life throws a curveball.

Table for income from $50,000 to $800,000 using the 28% rule for maximum recommended housing payment:

| Annual Salary | Monthly Gross Income | Max Housing Payment (28%) |

|---|---|---|

| $50,000 | $4,167 | $1,167 |

| $75,000 | $6,250 | $1,750 |

| $100,000 | $8,333 | $2,333 |

| $125,000 | $10,417 | $2,917 |

| $150,000 | $12,500 | $3,500 |

| $175,000 | $14,583 | $4,083 |

| $200,000 | $16,667 | $4,667 |

| $250,000 | $20,833 | $5,833 |

| $300,000 | $25,000 | $7,000 |

| $400,000 | $33,333 | $9,333 |

| $500,000 | $41,667 | $11,667 |

| $600,000 | $50,000 | $14,000 |

| $700,000 | $58,333 | $16,333 |

| $800,000 | $66,667 | $18,667 |

🔹 Quick reminder: This is for total housing costs — not just the loan, but also taxes, insurance, HOA fees (if applicable).

🔹 At higher incomes, lenders may sometimes stretch the ratio slightly, but 28% keeps it very financially healthy.

Here’s a table using the 30% rule (meaning max recommended housing payment is 30% of gross income):

| Annual Salary | Monthly Gross Income | Max Housing Payment (30%) |

|---|---|---|

| $50,000 | $4,167 | $1,250 |

| $75,000 | $6,250 | $1,875 |

| $100,000 | $8,333 | $2,500 |

| $125,000 | $10,417 | $3,125 |

| $150,000 | $12,500 | $3,750 |

| $175,000 | $14,583 | $4,375 |

| $200,000 | $16,667 | $5,000 |

| $250,000 | $20,833 | $6,250 |

| $300,000 | $25,000 | $7,500 |

| $400,000 | $33,333 | $10,000 |

| $500,000 | $41,667 | $12,500 |

| $600,000 | $50,000 | $15,000 |

| $700,000 | $58,333 | $17,500 |

| $800,000 | $66,667 | $20,000 |

✅ At 30%, you're still in a reasonably safe financial zone, but remember:

-

It leaves a bit less flexibility for savings, vacations, or unexpected expenses.

-

Great for buyers in high-cost areas where housing eats a larger slice of the budget.

Ready to Start Your Home Search?

If you’re wondering "How much house can I afford?", or you're ready to start your home search in San Diego, I’m here to help.

I’ll walk you through every step — from getting pre-approved to handing you the keys to your new home!

✨ Contact me today to find out what you qualify for and take the first step toward homeownership.

Sarah Bourke, Realtor®

📞 619.972.9462

📧 sarahsdhomes@gmail.com

🌐 www.sarahsdhomes.com

Let's turn your homeownership dreams into reality!

#HomeLoanPreApproval #BuyAHomeInSanDiego #FirstTimeHomeBuyer #HomeBuyingProcess #HomeAffordability #RealEstateSanDiego #FindYourHome #RealEstateExpert #MortgageApproval #YourRealtorForLife #whoyouworkwithmatters #SanDiegoRealtor #SarahSD

Categories

Recent Posts

GET MORE INFORMATION