Understanding Intrest Rates and how they affect Buying and Selling Real Estate

Understanding Interest Rates and Their Impact on the Real Estate Market

1. What Are Interest Rates?

At its core, a mortgage interest rate is the cost you pay to borrow money for a home, expressed as a percentage of your loan amount. For example, if you borrow $400,000 at a 6% interest rate, you’ll pay interest in addition to repaying the $400,000 principal.

Rates are set based on a combination of factors—economic conditions, inflation, the Federal Reserve’s policy decisions, and the overall demand for borrowing. Your personal rate also depends on your credit score, down payment, and the type of mortgage you choose.

2. Current Interest Rate Trends

As of August 2025, average mortgage rates in North America are hovering around:

-

30-year fixed: ~6.6%

-

15-year fixed: ~5.9%

-

5/1 ARM (adjustable rate): ~6.1%

Rates have eased slightly from their 2024 highs, when inflation pushed borrowing costs to their highest levels in two decades. However, they remain well above the historic lows seen during 2020–2021, when some buyers locked in rates under 3%.

Click here to see today's current rates!3. What Higher or Lower Rates Mean for Buyers

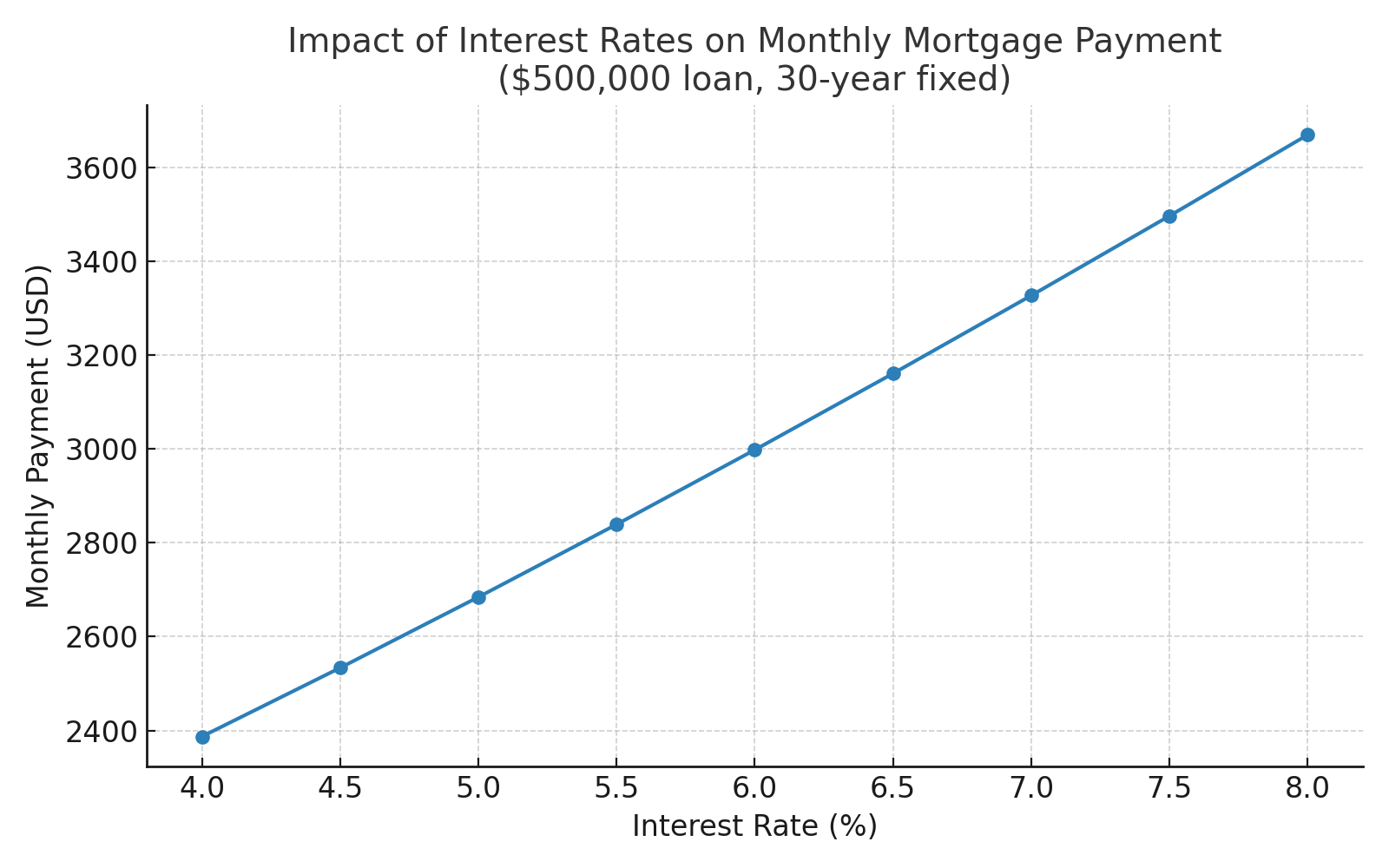

Interest rates directly shape a buyer’s monthly payment and overall affordability. Even a small change can make a big difference:

-

Higher rates → Larger monthly payments, reduced buying power, and potential difficulty qualifying for the same loan amount.

-

Lower rates → More affordable payments, increased purchasing power, and the ability to consider more expensive homes without raising the monthly cost.

For example, on a $500,000 loan, a 1% increase in interest rates could add hundreds of dollars to the monthly mortgage payment.

4. How Interest Rates Affect Sellers

While buyers feel the most immediate impact, sellers should care too:

-

Higher rates can cool buyer demand—fewer qualified buyers means homes may take longer to sell and offers might come in below asking.

-

Lower rates often spark a surge in activity, as more buyers can afford to enter the market, sometimes leading to bidding wars and higher sale prices.

In short: rates influence how quickly your home sells and for how much.

5. Buydown Options: A Win-Win Tool

A buydown is when the seller, builder, or buyer pays an upfront fee to reduce the interest rate for a set period (or permanently). This makes the loan more affordable—especially when rates are high.

Types of Buydowns:

-

Permanent Buydown – Pay points upfront to lower the rate for the life of the loan.

Example: Paying 1% of the loan amount might lower the rate by ~0.25%.

Good for buyers planning to stay long-term. -

Temporary Buydowns – Reduce the rate for the first few years, then it reverts to the standard rate.

-

3-2-1 Buydown – Rate is 3% lower in year 1, 2% lower in year 2, 1% lower in year 3, then standard after.

-

2-1 Buydown – Rate is 2% lower in year 1, 1% lower in year 2, then standard after.

-

1-0 Buydown – Rate is 1% lower in the first year only.

-

Why They Help:

-

For Buyers: Lower early payments ease the transition into homeownership, especially if income is expected to grow.

-

For Sellers: Offering a buydown can make your listing stand out without dropping the asking price.

6. Tips for Navigating the Market

For Buyers:

-

Get pre-approved early—know your budget before rates move.

-

Consider shorter loan terms or adjustable-rate options if you expect to refinance later.

-

Shop multiple lenders; even a 0.25% difference can save thousands.

For Sellers:

-

Monitor rate trends—listing when rates dip can attract more buyers.

-

Price strategically if rates are high; value and presentation matter more in a slower market.

-

Offer buyer incentives (e.g., rate buydowns) to make your property more appealing.

Bottom Line:

Interest rates may feel like just a number, but they drive the pace, pricing, and psychology of the real estate market. Whether you’re buying or selling, understanding how they work—and where they’re headed—can help you make smart, timely decisions. To learn more about buying or selling your home in today's market contact me today, Sarah Bourke Realtor®️ | Coldwell Banker West | 619.972.9462 | SarahSDhomes@gmail.com | www.SarahSD.com Dre #02151662.

Categories

Recent Posts

GET MORE INFORMATION