Real Estate Investing 101 What you NEED to know about your options.

Categories

Recent Posts

MAX Mortgage or Rent you should pay based on your income in San Diego

Your Guide to Point Loma and Ocean Beach

NEW LISTING!! Fall in LOVE before you step inside this Mediterranean masterpiece in Point Loma with bay and city VIEWS and the GARDEN of your dreams!

What changes can we expect in the Real Estate Market in 2025

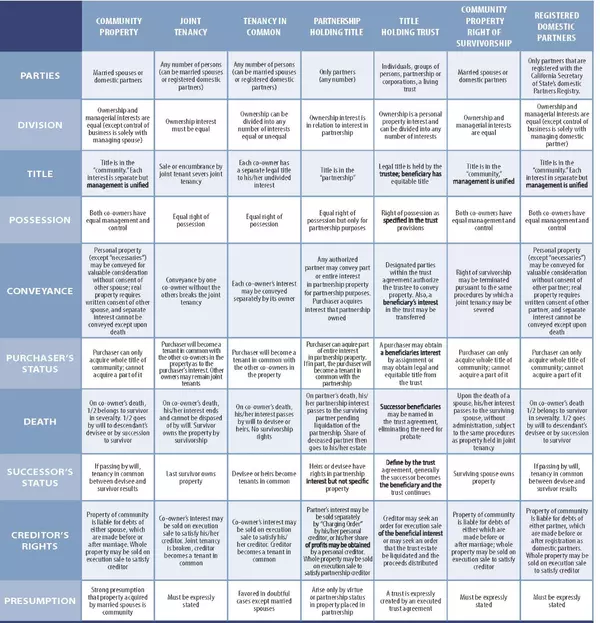

What you NEED to know about taking Title or Vesting in California

Tax Benefits of Buying a Home this Year ... and there's still time!

What to look for in a Real Estate Agent

Should you wait until intrest rates fall to purchase a home?

What's going on with realtor commissions?!

Do I need to pay a buyers agent to buy Real Estate?