HOW MUCH SHOULD I PUT DOWN ON A HOME? CAN I BUY WITH LESS THEN 3% DOWN?

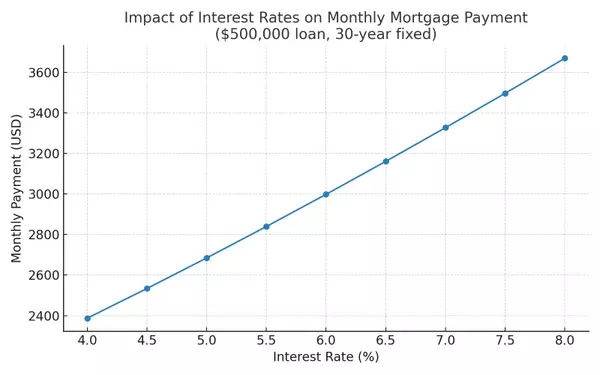

The amount of down payment you need for a home purchase depends on various factors, including the purchase price of the home, the type of mortgage you choose, and the requirements set by lenders. Typically, lenders require a down payment of 20% of the home's purchase price to avoid private mortgage insurance (PMI). However, it's important to note that there are options available with lower down payment requirements.

Here are some common down payment options:

1. 20% Down Payment: This is the traditional benchmark for avoiding PMI and may also provide you with more favorable loan terms.

2. 3%-10% Down Payment: Some lenders offer loan programs that require a lower down payment, such as 3% or 5%. These options may require PMI and may have stricter qualifying criteria.

3. FHA Loans: The Federal Housing Administration (FHA) offers loans with down payments as low as 3.5% for borrowers who meet their eligibility requirements. FHA loans have certain mortgage insurance requirements.

4. VA Loans: If you are a qualifying veteran or active-duty service member, you may be eligible for a VA loan, which typically does not require a down payment.

5. USDA Loans: The United States Department of Agriculture (USDA) offers loans with no down payment requirements for eligible low-to-moderate income borrowers in rural areas.

It's essential to consult with lenders or mortgage professionals to understand the specific down payment requirements based on your financial situation, credit history, and the type of loan you intend to pursue. Click here for a affordability calculator to see how much you can afford. To read more about how much you can afford click here for this insightful Wall Street Journal article.

Click here to see current homes on the market, or call me today for all your real estate questions 619.972.9462. Thanks for reading and hope it was helpful and informative.

Categories

Recent Posts

GET MORE INFORMATION