Should I sell my home during or after divorce? How to protect yourself financially now and in the future in California when going through a divorce.

When it comes to the family home, often the couple's largest asset, you need to know how to avoid pitfalls and make an educated decision to protect yourself now and the years down the line. Read on to learn your options and tips to protect yourself. In addition, I strongly advise that you consult with a trusted legal advisor and tax professional for advice on your specific and unique situation.

You have 3 main options when it comes to your marital home:

- One Spouse Buys out the other- One spouse usually refinances the mortgage, sometimes the lender will allow you to roll the buyout into the refinance to pay out the other party. It's more complicated than it sounds and involves factoring in your initial investment, agreed-upon equity, and in some cases possibly future appreciation.

- Co-Own the Home- Agreed upon the division of mortgage payment, home expenses, taxes, insurance, etc. Even though one spouse lives in the home if the mortgage isn't paid, it can negatively affect both parties credit scores (assuming both parties are on the mortgage). There is a large amount of trust and communication required in this scenario, this can get extremely complicated and controversial.

- Sell the home and divide any proceeds- this is the most popular and arguably cleanest option. There is the issue of agreeing upon who's managing the sale, who's staying in the house until the sale and agreeing upon many other selling factors. There is also the concern of capital gains tax, you get to write off up to $500k of equity as a married couple filing jointly if you've lived in the primary residence for two years, and up to $250k of equity as a single person. There are many more intricacies, so it is extremely vital you have a trusted, experienced Divorce Specialist Realtor®, a legal advisor, and a tax specialist.

This brings me to my next 5 guidelines...

1. Moving On

When deciding to sell your family home, you may ask yourself, who bears the financial responsibility? What needs to be done to ensure a quick and profitable sale? Who will choose the Realtor®?

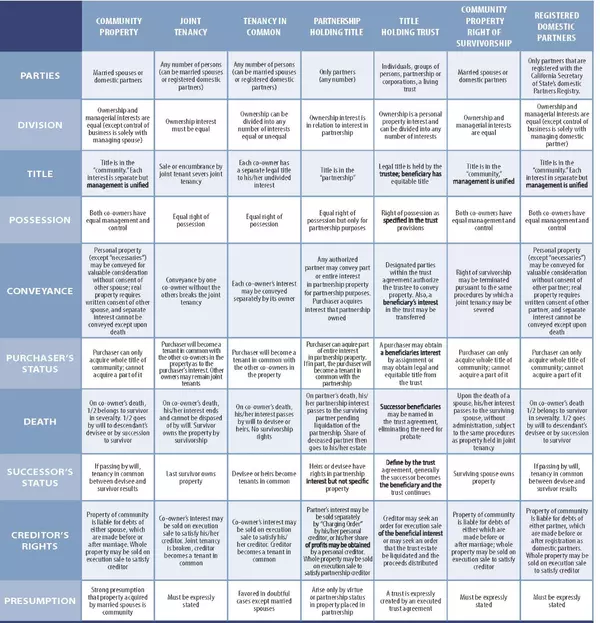

Doing your due diligence and researching what to expect will put your fears at bay. California is considered a "community property" state, which means we follow the rule that all assets acquired during the marriage are considered "community property". This also applies to debts, no matter who created the liability. Both assets and debts accumulated during the marriage are to be divided equally in a divorce.

- Terms to understand and discuss with your legal advisor

Mortgage- legal agreements made to buy a property/home. The lender's security interest is on record when the title is registered. The mortgagee (lender) may obtain a foreclosure order to take possession if payments of the debt are in default.

Property Title- refers to ownership of that property and the right to use it.

Quitclaim Deed- transfers ownership from one spouse to another, but it does not transfer financial responsibility. To change names on the mortgage and transfer financial responsibility to one party, they must obtain new financing to buy out the other.

- Be Prepared to collect important documents

Know your financial standing, know whose name(s) is on the mortgage and whose name(s) are on the title. Also, know who's on the homeowner's insurance policy. Who is the beneficiary and if both parties are insured? Collect and immediately provide your attorney home insurance, property taxes, liens, mortgage and marital debts, and marital assets. This will help you decide how to best move forward. And if you should keep, sell or buy out the family home.

- If you decide to sell

It's a complicated decision and both parties need to weigh the advantages and disadvantages in the short and long term of one party staying in the family home or selling. If neither party desires and/or cannot afford to stay in the marital home selling might be the best option, consult your legal advisors on contingencies specific to your situation.

Stay reasonable and realistic with expectations, to divide equitably or equally, as the case may be, you will need to know the precise value of the property. There are several common valuation methods to determine the value.

Comparative Market Analysis (CMA)- your real estate agent will provide for you, it is an in-depth review of your home's worth in the current market, based on the recent sale prices of comparable homes.

Broker Price Opinion (BPO)- another type of estimate produced by a real estate agent in response to a request from a mortgage lender. Less elaborate, thus less costly, than an appraisal, but more involved than a CMA.

The Cost Approach- based upon what it would cost to reproduce your home new, minus depreciation and obsolescence. You would also need to factor in land value.

Professional Appraisal- usually required when a court is dividing the couple's assets. Although, not required you should also get a home inspection to help uncover any issues invisible on the surface, to get a more realistic idea of what to expect when you sell your home (most buyers will require repairs and or credits for issues that come up on a home inspection).

- Finding the right REALTOR®...

This is extremely important, most people know a real estate agent, but don't jump headlong into working with friends who 1) may not be experienced at working with couples amid a divorce or 2) may not be impartial to both spouses.

You may need a Divorce Specialist Realtor® trained in legal and tax aspects of divorce. If the house is handled improperly during the divorce, the result could be that one or both spouses end up ineligible to qualify for a mortgage for many years. A real estate professional experienced in the divorce niche can provide clients with step-by-step guidance to protect themselves legally and financially.

I'd be happy to provide my expertise and services to help you buy or sell your home. Please reach out to me today!

Sarah Bourke, Realtor® and Divorce Specialist

619-972-9462 or email: SarahSDhomes@gmail.com

If you'd like to learn more about selling your home due to divorce click the link to the full version of my book, A Guide to selling your home after divorce

Categories

Recent Posts

GET MORE INFORMATION