The Ultimate Guide For First Time Home Buyers: Everything You Need To Know

The Ultimate Guide For First Time Home Buyers: Everything You Need To Know

The process of buying a home for the first time can be both exciting and daunting. There are so many things to consider, from finding the right property to getting the best mortgage rate. It’s important to do your research and seek out professional advice to make sure you are getting the best possible deal.

Engaging the services of a real estate agent is a good place to start. A good agent will work with you to find the right property, negotiate the purchase price, and assist with the paperwork and other details involved in the buying process.

The Process of Buying a House

The first step to buying a house is to decide what type of property you are looking for. Are you looking for a single-family home, a duplex, a condo, or something else? Once you’ve determined that, you will need to decide on a budget and start the process of searching for a home. It’s important to make sure you view several properties, so you can compare sizes, prices, and features. You should also read the disclosure documents, which will tell you about the condition of the home and any potential liabilities. You may decide to have a building inspector come in to give an opinion on the condition of the home before you make an offer.

Financing Your Home

Once you have chosen a property and you’re ready to make an offer, you will need to apply for a loan or mortgage to finance the purchase. Before you start looking for a lender, you should have a good idea of how much you can afford to borrow and what type of mortgage you are interested in.

Types of Mortgage Loans

There are several types of mortgage loans available, including conventional, FHA, VA, and jumbo loans. Conventional loans are the most common, and they require as little as 3 percent down payment or you can choose to put down a minimum of 20 percent in order to avoid having to pay PMI (private mortgage insurance). Keep in mind once your principal balance reaches 78% of the original appraised value of your home your PMI will automatically terminate. FHA loans are more flexible, with a down payment requirement of 3.5 percent or higher. VA loans are available to military members, veterans, and their spouses, and these loans come with no down payment requirement and don't require PMI. Finally, jumbo loans are for properties that exceed the conventional loan limits, and these loans usually require a larger down payment.

The Mortgage Application Process

Once you have chosen a lender, you will need to fill out a mortgage application. This will include providing details about your employment, income, and other financial information. Your lender will use this information to determine whether or not you are eligible for a loan, and if so, how much you are eligible for. You should also expect to provide financial documents, such as bank statements and tax returns. The lender will use these documents to verify your income and assets, and ultimately decide how much they are willing to lend you.

The Home Inspection

Once you have been approved for a loan, you will need to have a home inspection done on the property. A home inspector will check the home for any safety or structural issues, and this report will provide buyers with important information to help them decide whether or not to purchase the home. It can also be a negotiation tool to ask for repairs and/or credits, your Realtor should be able to guide you on what's standard and reasonable.

The Appraisal

After the inspection, an appraiser will need to be hired to determine the value of the property you are buying. The appraiser will compare the home to similar properties in the area and use that data to come up with a value. The appraisal will help the lender decide if the amount of the loan is in line with the value of the property.

The Closing

Once the appraisal is done and the loan is approved, you will need to go through the closing process. This process involves signing all the documents needed to transfer the title of the property and make the loan legal. The closing will include signing the loan documents, the deed, the title, and other related documents.

Taxes and Insurance

Once the closing is done, the title of the property will be officially transferred. At that point, you will need to start making payments on the loan and any associated taxes and insurance. It’s important to make sure your mortgage payment is made on time each month, as missing payments could result in penalty fees or potential foreclosure.

Moving In

After you have completed all of the above steps, it’s finally time to move in! This is an exciting time and you should take the time to make sure everything is in order. You may need to purchase additional items for your home, or make repairs that were noted during the inspection.

Conclusion

Buying a home for the first time can be a daunting process, but it can also be incredibly rewarding. Knowing what to expect and following the steps outlined in this blog post will help ensure that you have a successful and smooth home buying process. By taking a few moments to research the process, familiarize yourself with the different types of mortgage loans, and engage the services of a real estate agent, you will set yourself up for a successful experience.

Where should you start?

If you’re unsure whether to continue renting or to buy a home, let’s connect to help you make the best decision. Here is a FREE buyers guide so you can prepare and educate yourself on terminology and what to expect through the buying process if you chose that option.

Want to see what's active on the market right now? Click here to search current homes on the market. Better yet call or text me today at 619.972.9462 to set up a meeting so we can make a plan to get you into your first home, your next home, or buy an investment property.

Categories

Recent Posts

Thinking about Relocating to San Diego — Now Might Be the Perfect Time , and How to Make It Happen

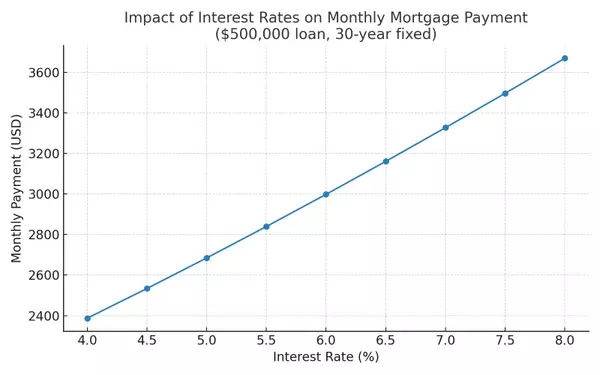

Understanding Intrest Rates and how they affect Buying and Selling Real Estate

MAX Mortgage or Rent you should pay based on your income in San Diego

Your Guide to Point Loma and Ocean Beach

NEW LISTING!! Fall in LOVE before you step inside this Mediterranean masterpiece in Point Loma with bay and city VIEWS and the GARDEN of your dreams!

What changes can we expect in the Real Estate Market in 2025

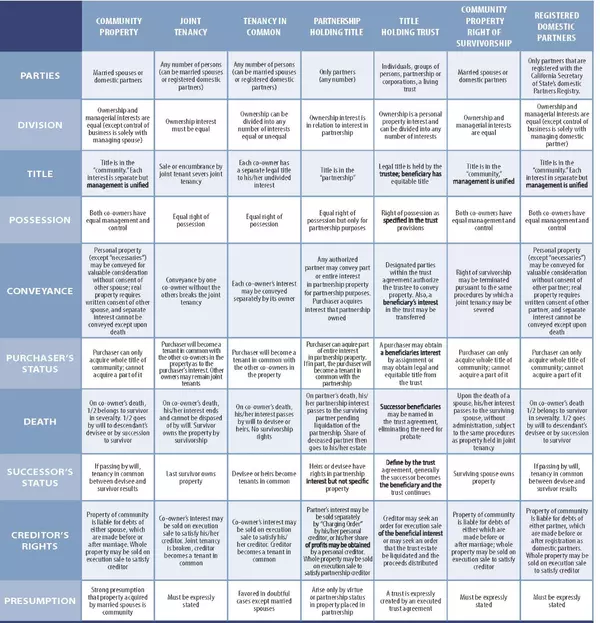

What you NEED to know about taking Title or Vesting in California

Tax Benefits of Buying a Home this Year ... and there's still time!

What to look for in a Real Estate Agent

Should you wait until intrest rates fall to purchase a home?

GET MORE INFORMATION