What do I need to know about Title Insurance?

What do I need to know about Title Insurance?

Title insurance is an essential part of any real estate transaction, providing protection to both buyers and sellers. Whether you're purchasing a property or selling one, understanding the importance of title insurance is crucial. In this blog post, we'll explore the significance of title insurance for buyers, sellers, and highlight some recent real estate news related to this topic.

For Buyers:

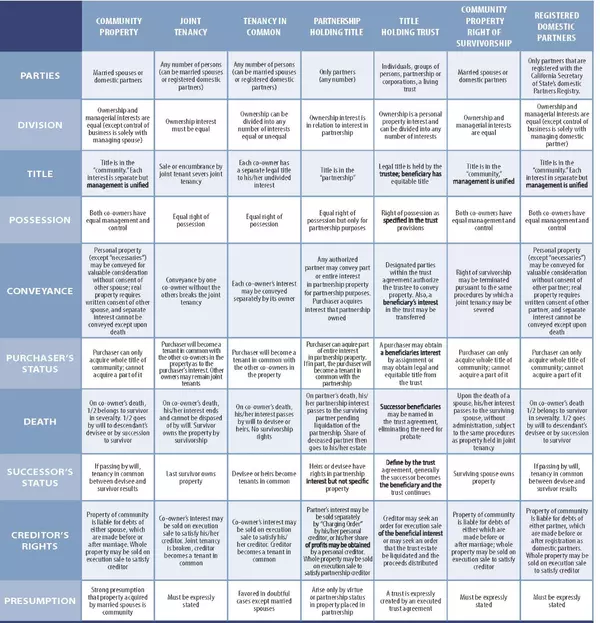

Title insurance offers buyers peace of mind by protecting them against unforeseen issues that may arise with the property's title. It ensures that you have legal ownership and that there are no outstanding claims, liens, or other encumbrances on the property. By securing a title insurance policy, you're safeguarding your investment and minimizing the risk of potential financial loss in the future.

When purchasing a property, it's crucial to conduct a thorough title search to uncover any hidden issues. This search will reveal if there are any existing liens, judgments, or unpaid taxes that could affect the property's title. If any problems are discovered, the title insurance policy will cover the costs associated with clearing these issues, ensuring a smooth and worry-free closing.

For Sellers:

Title insurance is equally important for sellers, as it protects them against any potential claims or defects that may arise after the property's transfer. By providing a clear title to the buyer, sellers can enhance the marketability of their property and potentially attract more buyers. In case a claim arises, the title insurance policy will cover the legal costs of defending against the claim, protecting the seller's finances and reputation.

Real Estate News:

In recent real estate news, there has been a surge in cyber fraud related to title insurance. Hackers are targeting real estate transactions, manipulating wire transfer instructions, and diverting funds intended for closing. This highlights the need for both buyers and sellers to work with trusted professionals and remain vigilant throughout the transaction process. It's crucial to verify all wire transfer instructions over the phone and be cautious of any suspicious email correspondence.

Additionally, title insurance companies are constantly adapting their policies to address emerging risks in the market. For example, some policies now cover losses resulting from zoning violations, building permit issues, and other zoning-related matters. This evolving landscape emphasizes the importance of staying informed and working with experienced professionals to ensure comprehensive protection.

In conclusion, title insurance plays a vital role in real estate transactions for both buyers and sellers. It offers protection against unforeseen issues that may arise with a property's title, ensuring a smooth and secure transfer of ownership. By understanding the significance of title insurance and staying informed about the latest trends in the market, buyers and sellers can make informed decisions and protect their investments. To learn more or to work with a professional in the Real Estate industry please contact me directly, Sarah Bourke Realtor® 619.972.9462 or click this link to visit my website.

Categories

Recent Posts

GET MORE INFORMATION